R&D Tax Automation for Professional Advisers

R&D Tax Computation and HMRC Submission – fully automated for the first timefor the first time

TaxEngine provides the software infrastructure R&D tax agencies have long needed – converting R&D expenditure and CT600s into accurate Tax Computations, Amended CT600s, and Submitted Claims.

Built specifically for R&D tax credit agencies and specialist accountants operating under increasing HMRC scrutiny.

What TaxEngine does

Automates the work R&D tax teams currently do by hand

TaxEngine automates core accounting and submission tasks that R&D tax credit agencies and specialist accountancy teams perform every day. What previously required hours of manual effort across multiple systems is completed in seconds — with greater accuracy and consistency.

How it works

- 1You upload reports containing R&D expenditure and CT600

- 2TaxEngine reads the documents

- 3TaxEngine repopulates the CT600 automatically with the correct costs

- 4TaxEngine produces its own structured Tax Computation and custom Amendment Summary

- 5TaxEngine queues claims for submission to HMRC

This is not advisory software. It is delivery automation infrastructure.

Inputs & outputs

Clear inputs. Clear outputs.

UPLOAD: INPUTS

TaxEngine ingests:

- 1Reports containing R&D expenditure

- 2CT600 (UK Corporation Tax Return form)

All inputs are securely uploaded and processed within the platform.

DOWNLOAD: OUTPUTS

TaxEngine produces:

- Amended CT600s reflecting R&D expenditure

- A valid R&D amended Tax Computation

Take time-consuming, manual, and sloppy work, and do it effectively in seconds, more accurately, and more consistently.

How it works

Automatic CT600 reconstruction, Tax Computation and custom Amendment Summary

When a CT600 or numbers document is uploaded, TaxEngine automatically scans and interprets the data.

CT600 Processing

- Reads CT600 figures directly from uploaded documents

- Reconstructs the CT600 including R&D expenditure

- Applies the correct boxes and classifications

- Eliminates manual re-keying and spreadsheet reconciliation

Tax Computation

TaxEngine then generates its own Tax Computation and custom Amendment Summary as part of the workflow.

- R&D expenditure incorporated accurately

- Clear audit trail retained

- Ready for professional review and approval

- Clear changes — easy for accountants to update their records

- Produces custom Amendment Summary to keep things clean

Game Changer

Free your team to do higher-value work

By automating the mechanical accounting and submission work, TaxEngine allows R&D professionals to focus on:

Your team focuses on

- technical analysis

- claim positioning

- narrative quality

- client advisory

- managing HMRC enquiries

The Result

The reality

The way R&D claims are delivered is evolving

The landscape for R&D tax credit firms has changed significantly. Standards are higher, margins are tighter. There's a better way to work.

Your most expensive employees (chartered accountants) could be doing more valuable work.

Free up experienced staff to focus on what they do best — advising clients and building relationships.

Manual data entry and complex spreadsheets still dominate workflows

Getting compliance right matters more than ever

Senior staff spend too much time on accounting work

Peak submission periods create operational bottlenecks

Trusted by 50+ Senior Chartered Accountants

There's a smarter way to deliver.

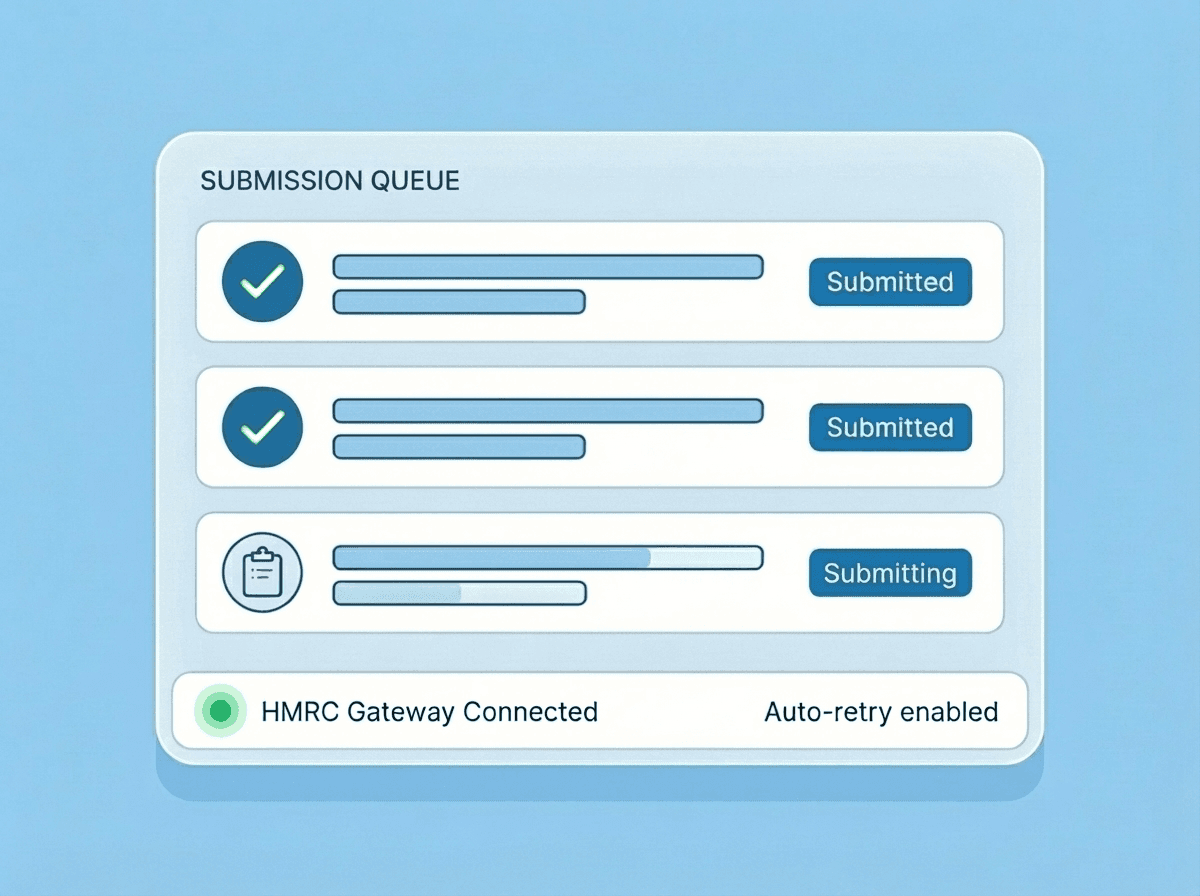

HMRC

Reliable submission to HMRC — even during peak periods

Submitting R&D claims at scale creates a practical problem: congestion at busy times. TaxEngine includes a purpose-built queuing and submission system that communicates seamlessly with the HMRC Government Gateway.

- Claims are queued for submission

- Automated interaction with the HMRC Government Gateway

- No manual retries or staff intervention

- Submissions continue reliably during peak periods

- Delivery teams are insulated from gateway slowdowns

Submit at scale without slowing down your team.

Standalone solution

Built specifically for R&D tax credit firms

TaxEngine is not adapted from general accounting or bookkeeping software. It removes the need to route R&D claims through tools designed for broader use cases.

No IRIS

No Xero

No TaxCalc

No Wolters Kluwer

Generic

No general accounting platforms

TaxEngine is built entirely for R&D tax credit agencies and specialist accountancy teams — so your team can focus on what they do best.

Compliance as standard

Designed for scrutiny, not shortcuts

TaxEngine is built for a compliance-led environment. The platform focuses on accuracy, consistency, and transparency — not aggressive optimisation.

All claims remain subject to professional review and approval.

Why trust TaxEngine

Security and data protection by design

UK-based hosting

Data remains in the UK

Encryption at rest and in transit

End-to-end protection

Role-based access controls

Granular permissions

Incident response procedures

Rapid response protocols

UK GDPR-aligned processing

Full compliance

TaxEngine acts as a data processor for UK GDPR purposes

Accountant partners

TaxEngine transforms how accountants work with R&D tax specialists. Streamlined collaboration, reduced admin, clearer boundaries. Everyone wins.

Why your accountant partners will be happy

Produces a clear amendment summary, making updates quick and simple

Takes full responsibility for submission, removing admin burden

Automatically emails all final documents for easy record keeping

Makes it easy for accountants to support clients without extra effort

Your accountant partners can focus on their core advisory role while TaxEngine handles all the R&D tax complexity behind the scenes.

Keeps R&D work clearly separate from the accountant's scope, avoiding confusion and insurance issues

Better partnerships, better results.

Enabling seamless collaboration between R&D specialists and accountants

About

Built by people who do this for a living

TaxEngine was built inside a UK R&D tax consultancy operating at scale. It was developed to solve real delivery problems under real regulatory pressure — and is now being made available to a limited number of professional firms.

✓Battle-tested software already used to process 3,000+ R&D tax claims

✓Millions of pounds recovered for clients

✓Used on behalf of 1,500+ companies

TaxEngine is a standalone software business and does not provide advisory services.

Contact

Talk to us

If you run an R&D tax credit agency or an accountancy firm with an R&D team and want to understand how TaxEngine could transform your delivery model, we'd like to talk.

Access is limited. TaxEngine is not a mass-market product.

Your goals

If you want to…

TaxEngine solves specific operational problems. Find yours below.

If you want to materially reduce the cost of delivering each R&D claim, TaxEngine removes the manual re-keying, reconciliation, and duplicated accounting work that quietly inflates delivery costs.

Typical impact:

- 20–40% reduction in delivery cost per claim

- Fewer write-offs caused by rework and corrections

Lower cost. Same (or better) quality.

If you want to eliminate repetitive CT600, tax computation, and amendment work, TaxEngine replaces manual processing with a single automated workflow.

Typical impact:

- 2–4 hours saved per claim

- Senior staff spend time advising, not re-typing

This is where the time actually goes — and where it comes back.

If you want every CT600, tax computation, and amendment summary to reconcile cleanly — every time — TaxEngine generates all outputs from the same underlying data.

Typical impact:

- Fewer internal review cycles

- Clearer submissions to HMRC

- Reduced avoidable enquiry triggers caused by inconsistencies

Consistency by design, not by checking.

If you want to handle more claims without hiring more delivery staff, TaxEngine removes peak-period bottlenecks and manages submission flow automatically.

Typical impact:

- 20–50% increase in throughput with the same team

- No submission slowdowns during busy periods

Scale volume without scaling risk.

If you want to reduce the operational drag caused by HMRC enquiries, TaxEngine removes common mechanical errors that trigger unnecessary scrutiny.

Typical impact:

- Fewer time-consuming follow-ups

- Faster responses when questions arise

- Less senior time spent in defence mode

Cleaner submissions. Stronger posture.

If you want your most experienced people focused on technical analysis, claim positioning, and client advisory — not spreadsheet mechanics — TaxEngine takes the mechanical work out of delivery.

Better use of talent. Better margins.

Then talk to us

TaxEngine is software infrastructure for R&D tax credit agencies and specialist accountancy teams that want to modernise delivery without increasing risk.

If you recognise the problems above, we should talk.

Request accessAccess is limited. TaxEngine is not a mass-market product.